In the case of the allowance for doubtful accounts, it is a contra account that is used to reduce the Controlling account, Accounts Receivable. Risk Classification is difficult and the method can be inaccurate, because it’s hard to classify new customers. As well, customers in any risk category can change their behavior and start or stop paying their invoices.

- T the end of an accounting period, when financial accounting reports are prepared and published, the sum of receivable accounts appears on the Balance Sheet as Accounts receivable.

- Under this, the company groups all its accounts receivable by age, i.e., as per their due date.

- If your company extends credit to customers, it’s prudent to reevaluate the adequacy of your bad debt allowance and make a reasonable adjustment to your reserves based on the disruption caused by COVID-19.

- After an amount is considered not collectible, the amount can be recorded as a write-off.

- Doubtful accounts are past-due invoices that your business does not expect to actually collect on before the end of the accounting period.

- This means the business credits accounts receivable and debits the bad debt expense.

The resulting figure is the new allowance for doubtful accounts number. Recording the amount here allows the management of a company to immediately see the extent of the expected bad debt, and how much it is offsetting the company’s account receivables.

Ready To Protect & Grow Your Business?

Remember, unpaid invoices weaken your cash flow and those additional costs will add up quickly. Utilizing an allowance for doubtful accounts if a customer doesn’t pay also requires more internal resources to manage the risk. Use the comparison chart below to see how much you might be costing your business. One common area where companies fail to evolve is in continuing to own their own risk when it comes to insuring their dummy accounts receivable. In these instances, business owners agree to accept the loss of any unpaid invoice amounts, plus the full costs required to manage their internal credit grading processes. These businesses use a bad debt reserve to offset losses, research customers of their own and own all the risk internally. Allowances for doubtful accounts are an important tool to help cover inevitable dummy non-payments.

The older a receivable becomes, the less likely it will be collected. A higher and higher allowance percentage will be assessed as the receivables age past their due date. Many companies will assume a receivable over ninety days past due should be assumed completely uncollectible.

Fundamentals Of Bad Debt Expenses And Allowances For Doubtful Accounts

The allowance for doubtful accounts is management’s objective estimate of their company’s receivables that are unlikely to be paid by customers. Use the accrual accounting method if you extend credit to customers. If a customer purchases from you but does not pay right away, you must increase your Accounts Receivable account to show the money that is owed to your business. Two likely culprits of unpaid invoices are dated accounts receivable processes and limited payment options, as they lengthen collection cycles. Typically, accountants only use the direct write-off method to record insignificant debts, since it can lead to inaccurate income figures.

- However, the customers sometimes pay the amount written off as bad debts.

- The only impact that the allowance for doubtful accounts has on the income statement is the initial charge to bad debt expense when the allowance is initially funded.

- The Allowance for Doubtful Accounts is a contra-asset account that estimates the future losses incurred from uncollectible accounts receivable (A/R).

- Doubtful accounts represent the amount of money deemed to be uncollectible by a vendor.

- For instance, if a certain percentage of accounts receivable has gone bad in the past, the company would also take the same percentage for the future assessment.

Thus under the percent of sales method, bad debt expense will be $12,400 higher and net income will be lower by that amount. Delays recognition of bad debt until the specific customer accounts receivable is identified. Once this account is identified as uncollectible, the company will record a reduction to the customer’s accounts receivable and an increase to bad debt expense for the exact amount uncollectible. It protects your capital, maintains your cash flows, and—most importantly—secures your earnings against defaults. When compared to self-insurnace, TCI provides you with a safer, more strategic accounts receivable management option. To break it down further, take a look at how both approaches compare for various aspects of your business. To establish an adequate allowance for doubtful accounts, a company must calculate its bad debt percentage.

Direct Write Off Method Vs Allowance For Doubtful Accounts

The balance sheet method is another simple method for calculating bad debt, but it too does not consider how long a debt has been outstanding and the role that plays in debt recovery. Allowance for uncollectible accounts is a contra asset account on the balance sheet representing accounts receivable the company does not expect to collect.

First, the company deploys the aging method to identify that $20,000 of the receivable has crossed the 100-days due date. Further, they scrutinize and identify that roughly $10,000 of these receivables would never be recovered.

If you have a significant amount of cash sales, determining your allowance for doubtful accounts based on percentage of accounts receivable collected will give you a higher margin of safety. However, this number might be too conservative and decrease your AR to unrealistic levels. Auditors recognize that accounting estimates are subjective and can be used to manipulate earnings. So, when evaluating the allowance for bad debts, they consider whether management is downplaying or postponing write-offs to artificially inflate assets and profits. During the COVID-19 crisis, management may feel excessive pressure from stakeholders to downplay economic distress. However, if a customer pays some amount back later, then the company will first have to reinstate the account that it initially wrote off. The journal entry for this will be accounts receivable debit and allowance for doubtful accounts credit.

When Customer Payment Is Overdue

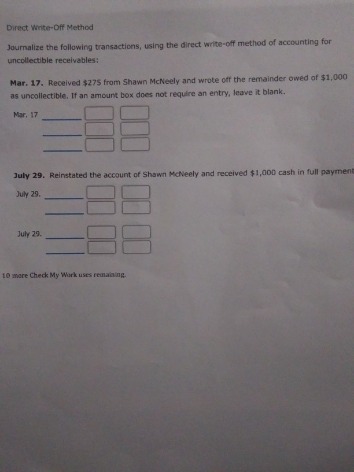

Under the direct write-off method, a business will debit bad debt expense and credit accounts receivable immediately when it determines an invoice to be uncollectible. In contrast, under the allowance method, a business will make an estimate of which receivables they think will be uncollectable, usually at the end of the year. This is so that they can ensure costs are expensed in the same period as the recorded revenue. A bad debt expense occurs when a customer does not pay their invoice for any of the reasons we mentioned earlier. This figure also helps investors estimate the efficiency of a company’s accounts receivable processes. BDE is reported on financial statements using the direct write-off method or the allowance method. The allowance for doubtful accounts is a reduction of the total amount of accounts receivable appearing on a company’s balance sheet, and is listed as a deduction immediately below the accounts receivable line item.

- On the other hand, the bad debt expense is an expense item on the income statement.

- There are several possible ways to estimate the allowance for doubtful accounts, which are noted below.

- Under the percentage of receivables method, we should use the accounts receivable aging report to determine the allowance for doubtful accounts.

- It does not necessarily reflect subsequent actual experience, which could differ markedly from expectations.

- Allowances for doubtful accounts are an important tool to help cover inevitable dummy non-payments.

- But, you’ll want to do everything in your power to prevent receivables from becoming uncollectible before things get to that point.

For example, a company has $7000 sales that are less than 100-days old and $3000 as more than 100-days old. On the basis of past data, the company knows that 1% of less than 100-days and 3% more than 100-days old sales get uncollectible on an average. The inherent uncertainty as to the amount of cash that will actually be received affects the physical recording process. To illustrate, assume that a company makes sales on account to one hundred different customers late in Year One for $1,000 each. The earning process is substantially complete at the time of sale and the amount of cash to be received can be reasonably estimated. According to the revenue realization principle found within accrual accounting, the company should immediately recognize the $100,000 revenue generated by these transactions. A contra asset account reflecting the estimated amount of accounts receivable that will eventually fail to be collected and, thus, written off as uncollectible.

How To Account For Bad Debts

So for an allowance for doubtful accounts journal entry, credit entries increase the amount in this account and debits decrease the amount in this account. The allowance for doubtful accounts account is listed on the asset side of the balance sheet, but it has a normal credit balance because it is a contra asset account, not a normal asset account. A company records $10,000,000 of sales to several hundred customers, and projects that it will incur 1% of this amount as bad debts, though it does not know exactly which customers will default. It records the 1% of projected bad debts as a $100,000 debit to the Bad Debt Expense account and a $100,000 credit to the Allowance for Doubtful Accounts. This is usually referred to as an income statement approach in which we use the income statement item (e.g. credit sales) as the base of the estimation. AccountDebitCreditBad debt expense$$$Allowance for doubtful accounts$$$In this journal entry, allowance for doubtful accounts is a contra account to accounts receivable on the balance sheet.

Secondly, the seller may recognize the debt as a bad debt expense and write off the debt. The invoice will state payment terms such as “Net 30,” or “Net 60,” which means the customer is obligated to pay the balance due no more than 30 or 60 days after receiving the invoice. Dummy uncollectible receivablesthey are trying to account for, any collateral the customer may be able to offer, the length of the customer relationship, and any recently implemented changes in credit policies.

When the estimation is recorded at the end of a period, the following entry occurs. It adds a significant delay between recognizing revenue from a transaction and identifying all expenses connected with that same transaction.

These options, however, can raise the cost of collection substantially. Second, examples show how transactions in “Allowance for Doubtful Accounts” turh unpaid debt into an ordinary expense. It helps customers in a tight financial position, helps customer compete confidently, and more. Learn key takeaways from a Euler Hermes analysis of 31 retail bankruptcies in the US involving companies with annual revenues exceeding $70 million. Dan North breaks down some of the key stats from the report as well as some of the good news about the potential for future employment recovery. Harold Averkamp has worked as a university accounting instructor, accountant, and consultant for more than 25 years.

How To Account For Credit Card Sales

It relies on the premise that the amount of bad debt can be accurately estimated based on historical accounting data. A transaction and its related bad debt expense are then recorded in the same time period, making the financial statements a more accurate record of transaction profitability. The percentage of credit sales approach focuses on the income statement and the matching principle. Sales revenues of $500,000 are immediately matched with $1,500 of bad debts expense.

Allowance For Doubtful Accounts, Bad Debt Expenseaccounting Steps When Customers Who Owe Do Not Pay

https://accountingcoaching.online/ helps report the bad debt expense as soon as the estimate is calculated and portrays a more accurate view of the financial statements. For both financial compliance and business health reasons, managing your doubtful accounts is important in your business. Unlike the percentage of sales method, we do not make the journal entry for allowance for doubtful accounts immediately. We need to determine the increase of allowance for doubtful accounts first as this amount will represent the expense that should be recorded in the income statement during the period. In business, losses due to uncollectible accounts tend to occur when we extend credit to increase sales resulting in many credit sales taking place during each accounting period.

Let’s use an example to show a journal entry for allowance for doubtful accounts. The the amount that a company keeps as bad debt reserve is determined by the company’s management and the nature of the industry. The information featured in this article is based on our best estimates of pricing, package details, contract stipulations, and service available at the time The allowance for doubtful accounts of writing. Pricing will vary based on various factors, including, but not limited to, the customer’s location, package chosen, added features and equipment, the purchaser’s credit score, etc. For the most accurate information, please ask your customer service representative. Clarify all fees and contract details before signing a contract or finalizing your purchase.